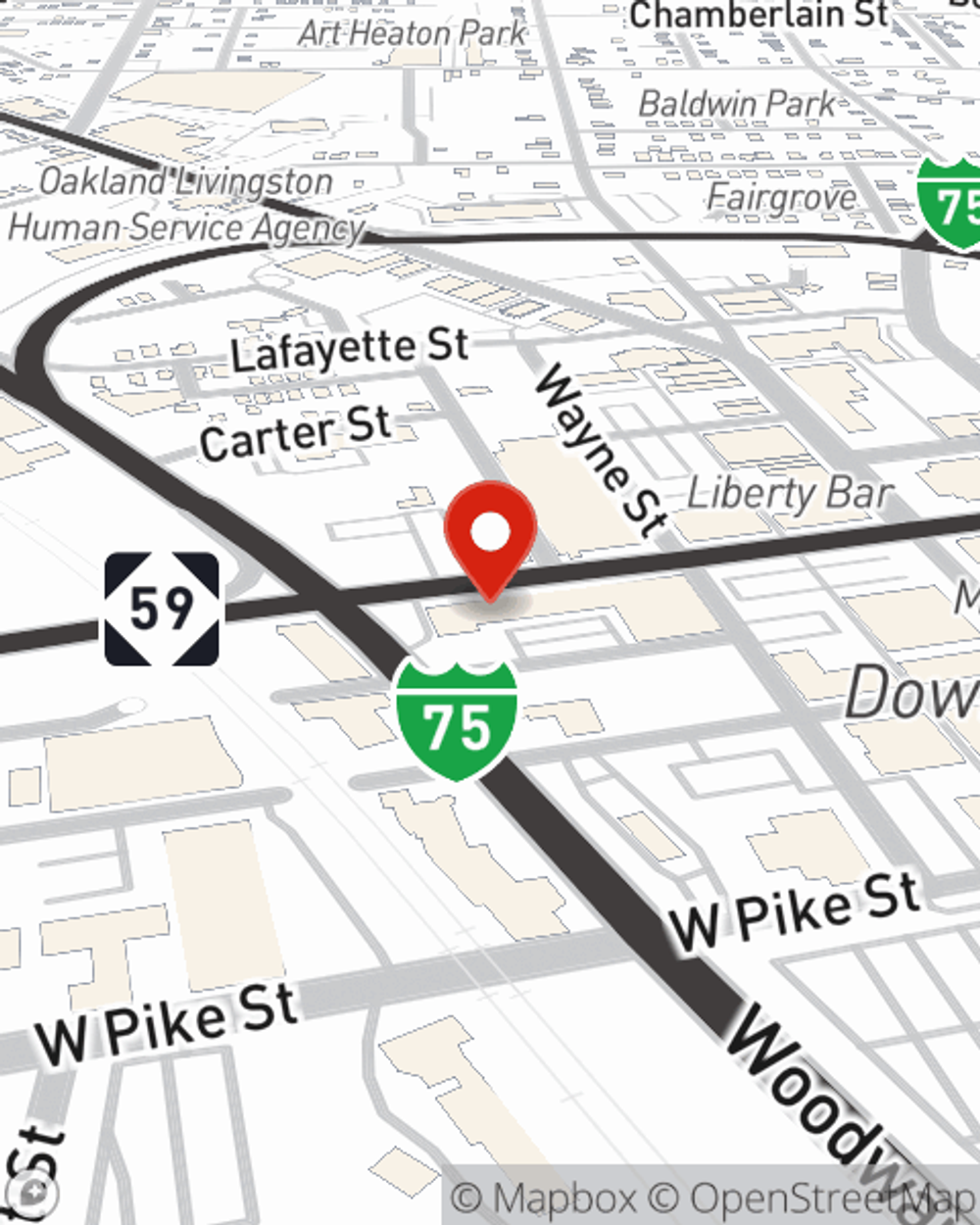

Business Insurance in and around Pontiac

One of the top small business insurance companies in Pontiac, and beyond.

This small business insurance is not risky

- Pontiac

- Waterford

- West Bloomfield

- Auburn Hills

- Bloomfield Hills

- Troy

- Birmingham

- Southfield

- Farmington Hills

- Ann Arbor

- Rochester Hills

- Warren

- Dearborn

Your Search For Excellent Small Business Insurance Ends Now.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Problems happen, like an employee gets hurt on your property.

One of the top small business insurance companies in Pontiac, and beyond.

This small business insurance is not risky

Protect Your Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Sam Cannonier is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Sam Cannonier can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and reach out to State Farm agent Sam Cannonier's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Sam Cannonier

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.