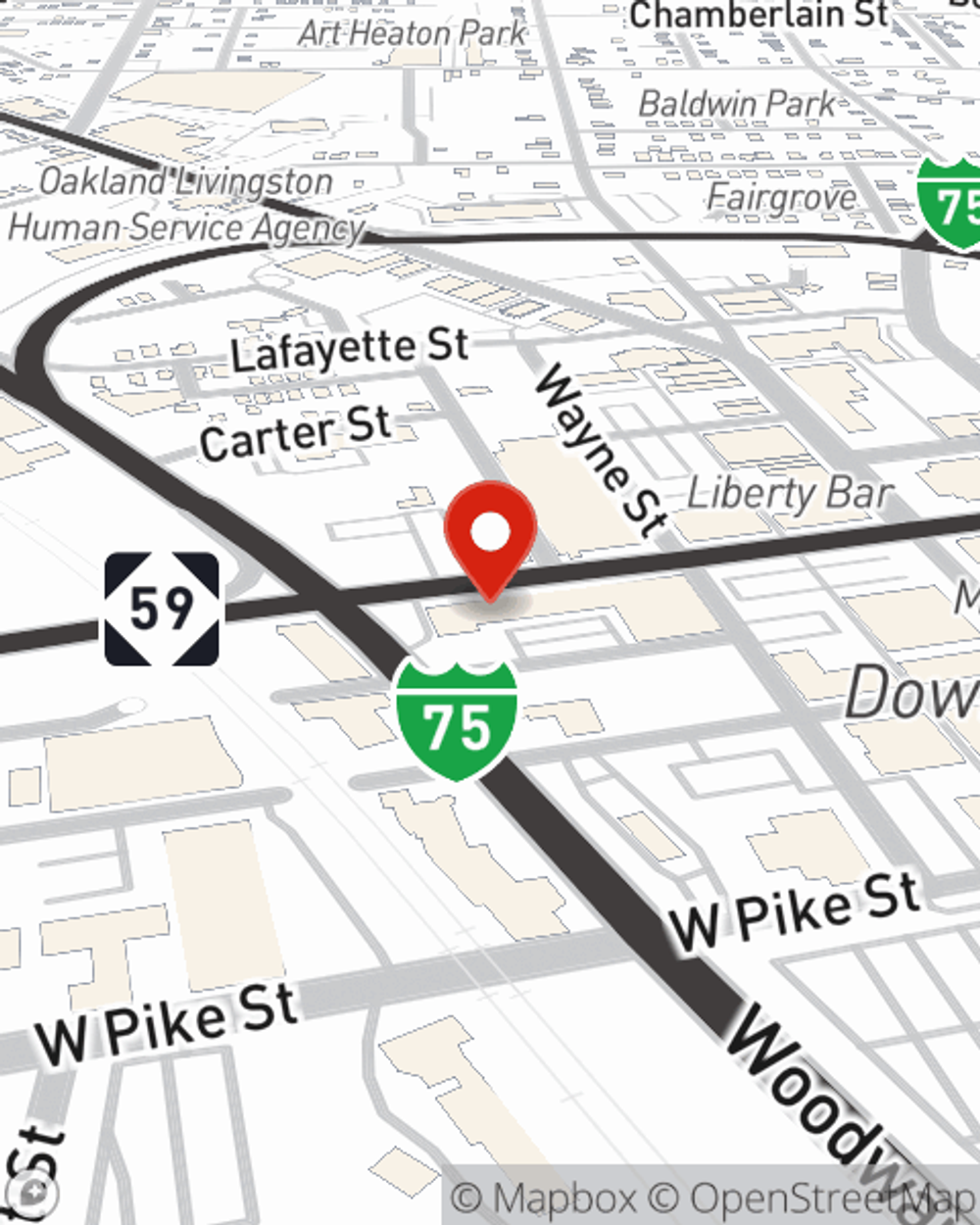

Renters Insurance in and around Pontiac

Your renters insurance search is over, Pontiac

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Pontiac

- Waterford

- West Bloomfield

- Auburn Hills

- Bloomfield Hills

- Troy

- Birmingham

- Southfield

- Farmington Hills

- Ann Arbor

- Rochester Hills

- Warren

- Dearborn

Home Sweet Home Starts With State Farm

Think about all the stuff you own, from your laptop to dresser to lamp to kitchen utensils. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Pontiac

Renters insurance can help protect your belongings

Why Renters In Pontiac Choose State Farm

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Sam Cannonier can help you create a policy for when the unpredictable, like an accident or a fire, affects your personal belongings.

There's no better time than the present! Call or email Sam Cannonier's office today to learn more about State Farm's coverage and savings options.

Have More Questions About Renters Insurance?

Call Sam at (248) 857-5800 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Sam Cannonier

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.